Be ready for Making Tax Digital for VAT

Unless you’ve been in hibernation for the last few months, you’ll know that Making Tax Digital for VAT is effective from 1 April 2019. Unless you are excluded, VAT data must be submitted digitally to HMRC after this date.

Award-winning tax expert, Mark Purdue, has kept us up to date on the progress of each phase of HMRC’s Making Tax Digital regime, the first of which is VAT. In our recent webinar, Mark gives the most detailed information yet as to the impact the regulation will have on UK accountants as we inch closer towards April.

What was covered in the webinar?

In just 30 minutes, Mark discusses what Making Tax Digital means and for whom, and the impact it is likely to have on accountants. He details the timeline for various client types and explains in simple terms how bridging software works. He also goes into depth during an extensive Q&A session.

Busting myths

Referred to by HMRC as the ‘soft-landing period’ mentioned in notice 700/22, it seems there has been some confusion as to its actual meaning. Mark refers to incorrect suggestions that ‘There are no penalties until April 2020’, and ‘I’ll wait for MTD to settle down because there’s a soft-landing period’. He clarifies that the soft-landing period does not in fact refer to penalties, but to there being digital links within software. Mark explains, “The soft-landing period relates only to digital links between your transactional record and the place where the return data is collated – the soft-landing period does not apply between your collated data and your submission software. That is not covered and must be in place from April 2019”. Mark continues, “Under no circumstances can you type in summary data directly into the product that will do the submission.”

He emphasises that ‘MTD is all about that digital linking of data and not re-keying in data from one place to another’.

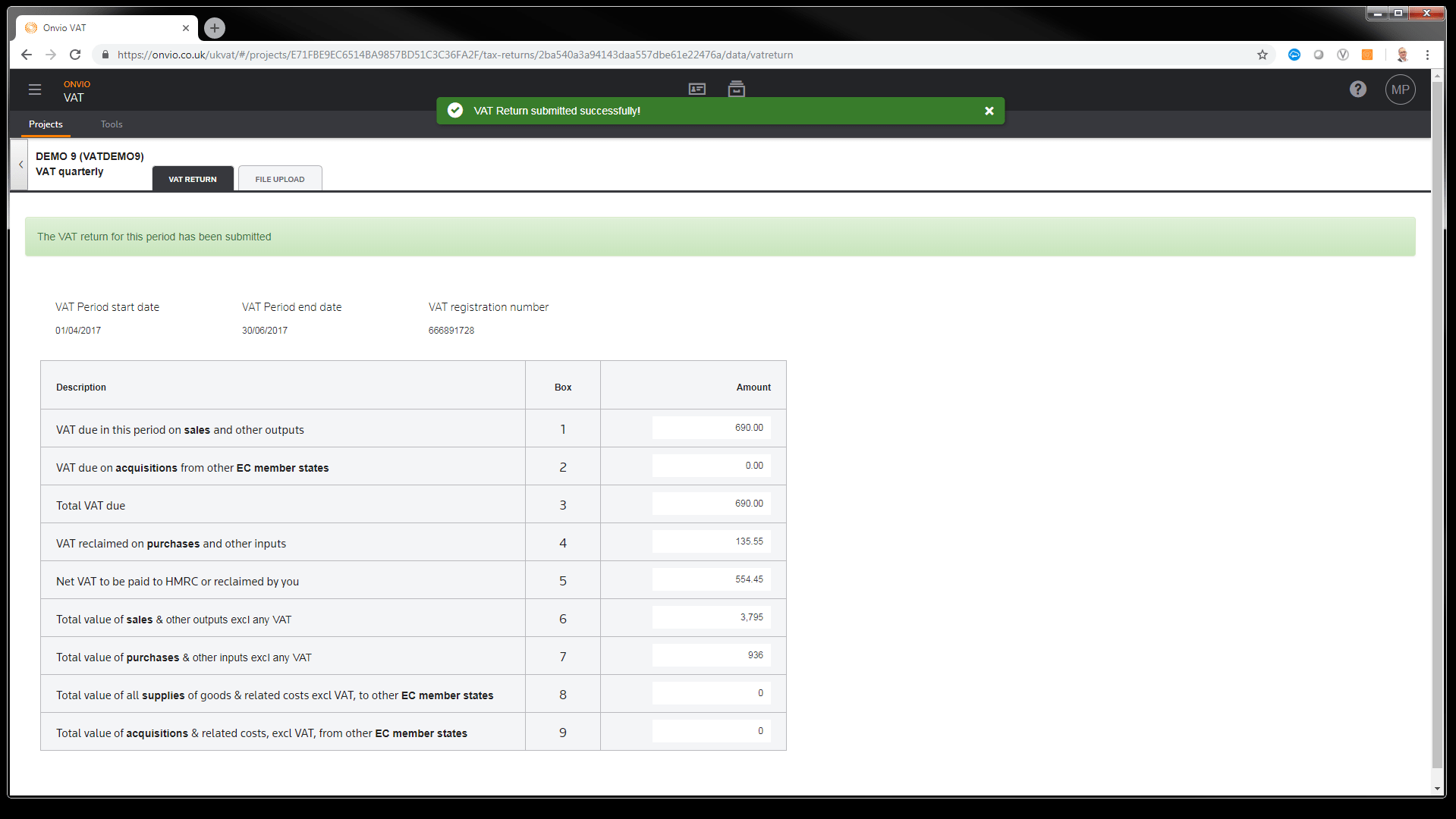

Onvio VAT

Part of our cloud-suite of compliance software, Onvio VAT is available to purchase now. During the webinar, Mark explains what is does and demonstrates its capabilities.

MTD beyond VAT

So, what next? VAT as the first phase of Making Tax Digital will be followed by Income tax and Corporation Tax. Mark suggests that although these next phases have taken somewhat of a back seat with HMRC while the focus is on VAT, he proposes there will be some communication from them about these aspects in due course. He denotes the pilot as “vital to the decision about whether or not and when, Income tax becomes mandatory.”

He concludes the topic by sharing his own personal view on the possible date for Income Tax phase: “…if the API’s are only complete or nearing completion in April 2020, there’s no way income tax can be mandated at that point…it is extremely unlikely that April 2020 will be the income tax date.”

Don’t miss this concise and comprehensive on-demand webinar from an expert you can trust – be ready for Making Tax Digital for VAT. Contact one of our account managers to find out more details about our solution.