Accountancy firms poised for major transformation of the profession by 2028

Survey by Thomson Reuters finds 96% of accountants expect technology to change their role within the next ten years.

LONDON, Tuesday 4th September, 2018 – Accountants forecast significant technological and business model change within the profession by 2028 according to new research from the Tax Professionals business of Thomson Reuters, the world’s leading source of intelligent information.

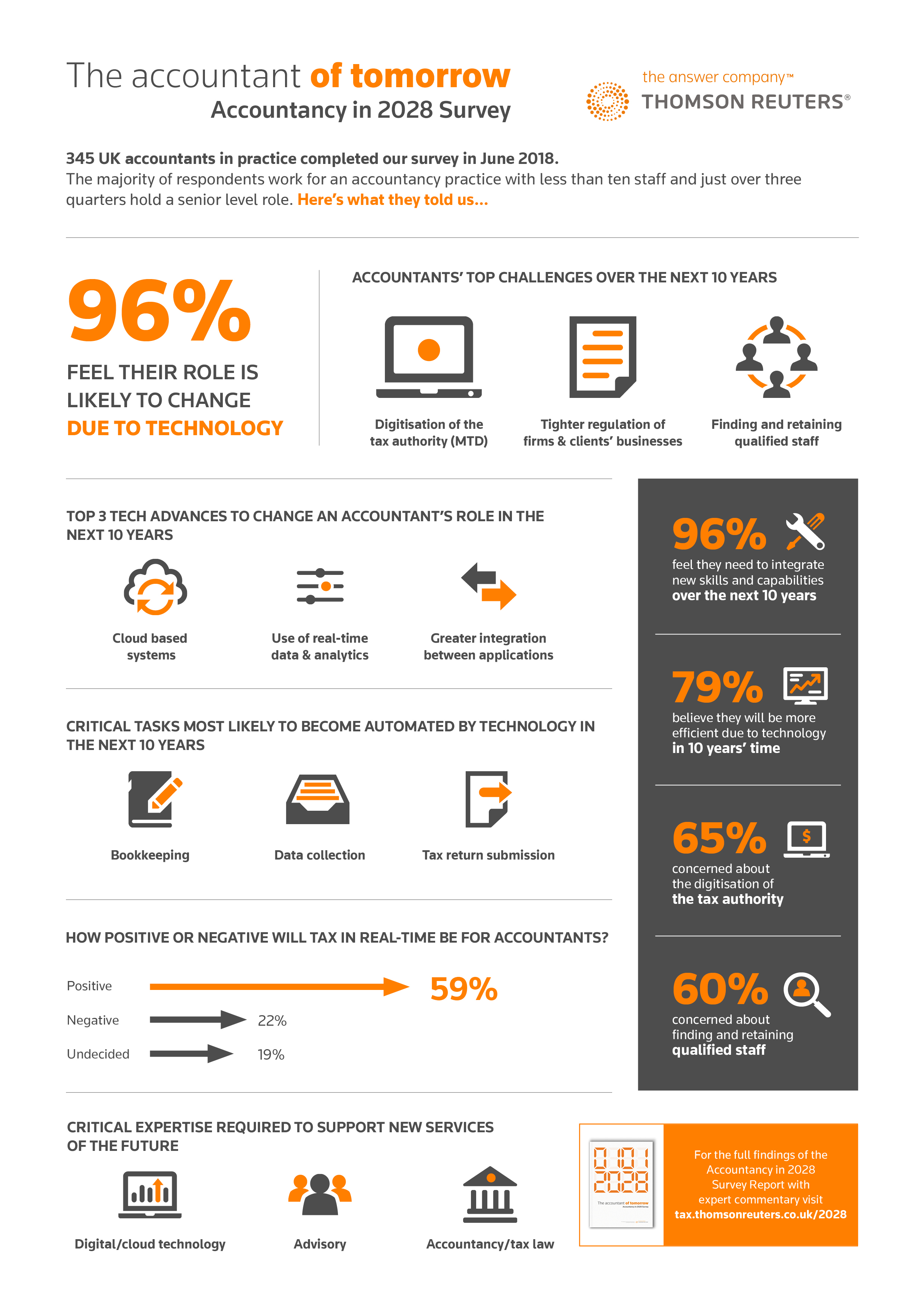

96% of mid- and senior-level accountants surveyed say advances in technology are likely to change their role as an accountant within the next ten years. The research suggests that technological advancements such as cloud computing (67%) and real-time data (52%) will have the biggest impact on the profession.

Despite concerns around tightening compliance regulations and the practicalities of change, respondents were optimistic towards the opportunities that advances in technology could bring. This was reiterated by two-thirds of accountants (59%) who see tax in real-time as a positive change for the profession.

Furthermore, the accountants surveyed acknowledge that diversification of services will be vital by 2028, as almost all (96%) agree that new skills and capabilities will need to be integrated into their role. This is coupled with an expectation that technology will automate key accountancy tasks such as bookkeeping, data collection and tax returns over the coming decade.

Of the future business opportunities presenting themselves, respondents foresee they will spend significantly more time on advisory services, such as reviewing clients’ internal systems and procedures, recommending IT systems, tax planning and consultancy, and business development plans.

The ‘accountant of tomorrow’ research was conducted in June 2018 and polled 345 accountants in practice. Qualitative research included in-depth interviews with four partner-level accountants.

Charlotte Rushton, president of the Tax Professionals business of Thomson Reuters, said: “The tax and accounting profession is facing multiple sources of meaningful change, including new legislation and a wave of new technology that will impact both their own and their clients’ businesses. These trends raise many new questions, such as which areas of practice may require less effort and, in turn, where practitioners can create new growth opportunities.”

Rushton continued: “Accounting and tax professionals who increase their focus on adopting and becoming proficient with next-generation technologies, while incorporating higher-value advisory services into their mix, will position themselves for a stronger future.”

Stephen Pell, founder of music accountancy firm Pell Artists, says: “The role of the accountant is certainly going to change, but for the better. Technology is going to make life much more enjoyable and rewarding for an accountant, and it will only bring benefits to the adviser, and to the client.”

Freddie Faure, Partner of CooperFaure Accountants, adds: “In 10 years’ time there will still be a need for my role as an accountant, as long as I progress with change and rebalance the core of bookkeeping services versus advisory services from a 50-50 split currently, to 25-75.”

To access a copy of the report, please visit: The accountant of tomorrow.

Thomson Reuters

Thomson Reuters is the world’s leading source of news and information for professional markets. Our customers rely on us to deliver the intelligence, technology and expertise they need to find trusted answers. The business has operated in more than 100 countries for more than 100 years. For more information, visit www.thomsonreuters.com.

CONTACT

Tina Allen, Director, Public Relations, +44 (0207) 542 3789

Laura Winter, Senior Account Manager, rt. +44 (0) 7817 105718