Infographic

Simplifying quarterly submissions for Making Tax Digital for Income Tax

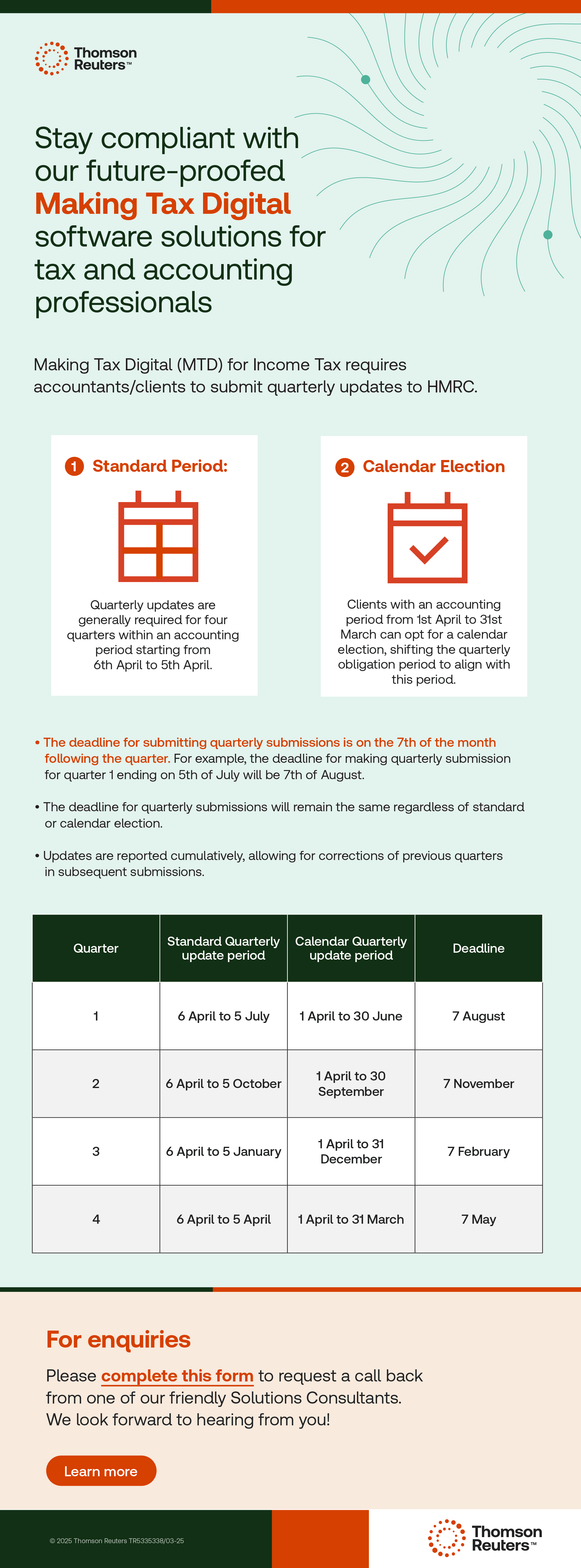

Our infographic simplifies the process for quarterly submissions under Making Tax Digital (MTD) for Income Tax. It covers standard and calendar election periods, submission deadlines, and cumulative updates. Stay compliant and efficient with our clear and concise visual guide, designed to enhance your understanding and streamline your tax reporting process.

Quarterly submissions

Making Tax Digital (MTD) for Income Tax requires accountants or clients to submit quarterly updates to HM Revenue and Customs (HMRC).

- Standard period. Quarterly updates are generally required for four quarters within an accounting period, starting from April 6 to April 5.

- Calendar election. Clients with an accounting period from April 1 to March 31 can opt for a calendar election, shifting the quarterly obligation period to align with this period.

- The deadline for submitting quarterly submissions is on the 7th of the month following the quarter. For example, the deadline for making quarterly submission for quarter 1 ending on 5th of July will be 7th of August.

- The deadline for quarterly submissions will remain the same regardless of standard or calendar election.

- Updates are reported cumulatively, allowing for corrections of previous quarters in subsequent submissions.

Quarter

Standard quarterly update period

Calendar quarterly update period

Deadline

1

6 April to 5 July

1 April to 30 June

7 August

2

6 April to 5 October

1 April to 30 September

7 November

3

6 April to 5 January

1 April to 31 December

7 February

4

6 April to 5 April

1 April to 31 March

7 May