BEPS Action Manager Ensure global BEPS compliance with ONESOURCE BEPS software

The BEPS software of choice for country-by-country reporting and sustainable worldwide compliance process

The international tax world is in the midst of profound change. The guidelines set forth by the OECD to combat Base Erosion Profit Shifting (BEPS) have led to a new global tax reporting landscape. Reporting requirements, data volume, complex global requirements and heightened scrutiny mean it’s more important than ever to gain control and transparency.

Action 13, specifically country-by-country reporting (CbC) is the first of 15 Action items requiring attention. Action 13 is the foundation from which BEPS compliance begins. Implementing technology to manage data and working with an advisor to reduce risk is an integral part in achieving compliance.

BEPS will only continue to evolve. Is your organisation positioned to effectively meet global BEPS compliance and reporting requirements?

Survey Report

2016 Global BEPS Readiness Report

This survey sheds light on how multinational enterprises are reacting to and preparing for the BEPS Action Plan. The findings uncovered trends, revealed risks and exposed pain points on a global scale. How are multinational enterprises preparing for BEPS-related compliance?

See the full report

Why Choose ONESOURCE for BEPS Compliance?

BEPS Action Manager was developed to provide unparalleled value across three areas in response to the OECD’s BEPS framework:

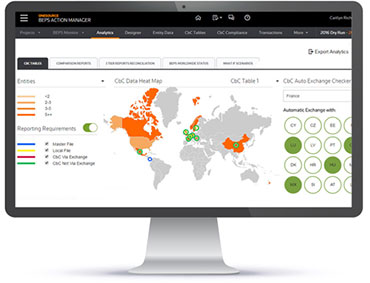

Thomson Reuters ONESOURCE BEPS Action Manager combines research, data management, entity charting, document storage, reporting and analytics in a single solution, enabling worldwide compliance and multidisciplinary collaboration for multinational enterprises in a post-BEPS era.

Whitepaper

Top 5 BEPS challenges

What impact will BEPS Action 13 have on your reporting process? Learn more about the top 5 country-by-country reporting challenges for multinational enterprises and how technology can solve them.

Learn more