We’re with You from Vine to Wine

Like crafting fine wine, the tax lifecycle is a long journey. From data management to analytics, only Thomson Reuters ONESOURCE™ has a comprehensive offering for every step of your direct tax processes.

Step into your tax lifecycle

Explore our interactive tool

Accounting for every step of the tax cycle.

Explore how ONESOURCE™ partners with you throughout every step.

just drag the slider

- Prepare

- Collect

- Utilise

- Deliver

- Reflect

What does your vine to wine journey look like?

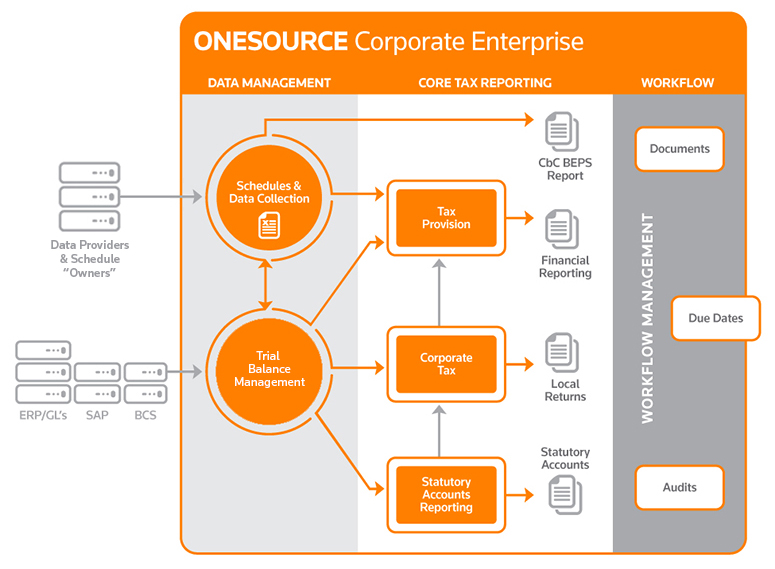

The Direct Tax Suite

Accounting for every step of the tax cycle.

Get In Touch Today

Tax Provision – ONESOURCE Tax Provision gives you control over the complete tax provision process. Collect the right information, calculate accurate tax accruals, and produce reports and workpapers that support the amounts that were booked — all on a tight deadline. Find out more

Corporate Tax – ONESOURCE Corporate Tax is designed by tax professionals, for tax professionals. Fully iXBRL compliant, ONESOURCE Corporate Tax facilitates the preparation and review of corporate tax returns and online filing. Find out more

Schedules & Data Collection – Most tax departments spend 80% of their time collecting and manually inputting data and 20% reviewing it. ONESOURCE DataFlow can flip those proportions and transform how you gather, use, store, and reuse data across your tax processes. Find out more

Statutory Accounts Reporting – Imagine a world of statutory reporting where the preparation and review process is simple: taking hours instead of days, having consistent data throughout the report and automating repetitive tasks. Find out more

Workflow Management – In an ever changing tax landscape, tax departments are increasingly in the spotlight to ensure they have a timely and accurate compliance process, combining automated statutory deadline tracking, document management, and data management. Find out more

Trial Balance Management – In an ever changing tax landscape, tax departments are increasingly in the spotlight to ensure they have a timely and accurate compliance process, combining automated statutory deadline tracking, document management, and data management. Find out more