VAT compliance software

Automate VAT Compliance with ONESOURCESimplify value-added tax (VAT) reporting and filing with software that increases efficiency, reduces cost, and lowers compliance risk

Request free demo

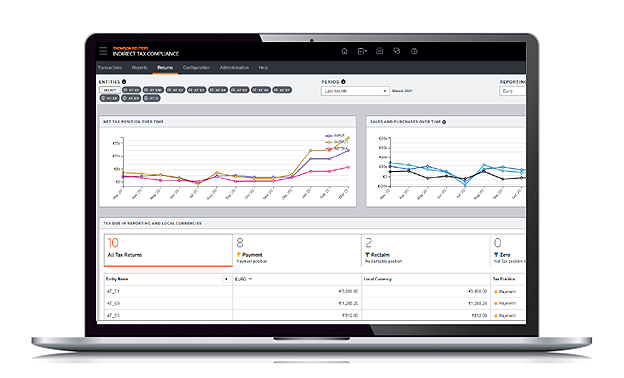

What can ONESOURCE Indirect Compliance do for you?

Easily prepare and file VAT returns, including S-II and SAF-T, on time worldwide

For global organisations, automating the way you prepare and report VAT, goods and services tax (GST), and other types of indirect tax and statutory filings allows you to move beyond complex, country-specific spreadsheets to help you stay compliant wherever you do business.

Request free demoHave questions?

Contact a representative

On-time VAT filings

Handle tax reviews and signoffs, manage deadlines, and track audited adjustments with comprehensive workflow and risk management controls.

Fewer audits

Ensure data integrity with hands-off import, cleansing, validation, and analysis so you can minimise the chances of audits and penalties.

Clearer reporting

Satisfy new and increasingly prevalent digital tax reporting requirements with built-in support for Spanish SII, Norway SAF-T, and more.

Latest updates

Receive automatically updated tax content and forms from tax authorities around the world, certified to SSAE 18 and ISAE 3402 standards.

Helping your business thrive

ONESOURCE Indirect Compliance standardises and accelerates the return filing process

Managing VAT compliance is becoming more challenging every year, with tax authorities demanding more information more frequently. Corporations are required to meet country-specific reporting obligations that have widely varying requirements and complexities. Even companies operating in a limited number of countries and those that may be exempt from VAT can have complex filing processes or significant partial exemption calculations to perform. ONESOURCE Indirect Compliance can help businesses navigate these complexities.

Frequently asked questions

VAT/GST compliance software is a specialised tool designed to assist businesses in meeting regulation requirements. Unlike general accounting software, these compliance tools have VAT/GST content and specifically focus on automating tasks related to VAT filings and reporting.

Our solution helps tax professionals avoid audits and penalties by automating VAT/GST compliance from importing the data to completing validation checks to reporting the filings to the tax authorities. It accelerates VAT/GST return preparation and filing and ensures adherence to rules and regulations. By streamlining these compliance activities, our solution reduces manual errors, improves efficiency, and provides businesses with better control and visibility over their VAT/GST obligations, ultimately helping them meet their compliance requirements.

- Provides reliable, up-to-date tax content for VAT/GST reporting for more than 60 jurisdictions and territories

- Manages data issues from legacy enterprise resource planning systems and functionality to manage exchange rates and other complexities

- Applies risk management controls across all functions, enabling review and sign-off processes and permitting audited manual adjustments

- Prepares Intrastat, EC Sales list, EU Purchase List, SAF-T reporting, and other local supplementary filings, with direct e-filing where allowable

- Uses robotic process automation for full end-to-end automation of compliance

- Provides comprehensive data analysis and standard or business custom interrogation checking, allowing confidence in data integrity

Yes, the solution supports digital tax reporting, including UK MTD, Spanish SII, SAF-T, Polish JPK, and other digital reporting requirements.

The solution maintains detailed records of transactions, adjustments, and filings. This information can be easily accessed and extracted, simplifying the audit preparation process. The solution's audit trails also contribute to transparency and accountability.

Yes, the solution is available in various configurations to cater to businesses of all sizes. Whether you are a small business or a large enterprise, there are solutions tailored to your specific needs, ensuring accurate and efficient VAT/GST compliance.

Yes, our solution is enterprise resource planning agnostic and can import data from almost any source system. Various import options are available, including pre-built connectors, APIs, SFTP, and manual. This ability ensures a smooth data flow between your accounting platform and the solution, reducing the need for manual data entry and time spent gathering data.