VAT calculation software

Harness the power of VAT determination with ONESOURCESimplify value-added tax (VAT) compliance by automating processes that drive greater efficiency with numbers you can count on

Request free demo

What can ONESOURCE VAT determination do for you?

Streamline value-added tax determination

Automate global indirect tax calculations for accurate VAT, goods and services (GST), sales and use, and excise taxes with a tax engine.

Request free demoHave questions?

Contact a representative

The value of an automated, single source of truth

Verified reporting

Streamline tax reporting with master data sourced from financial systems that ensure verified tax reporting information and governance.

Flexible rules and policies

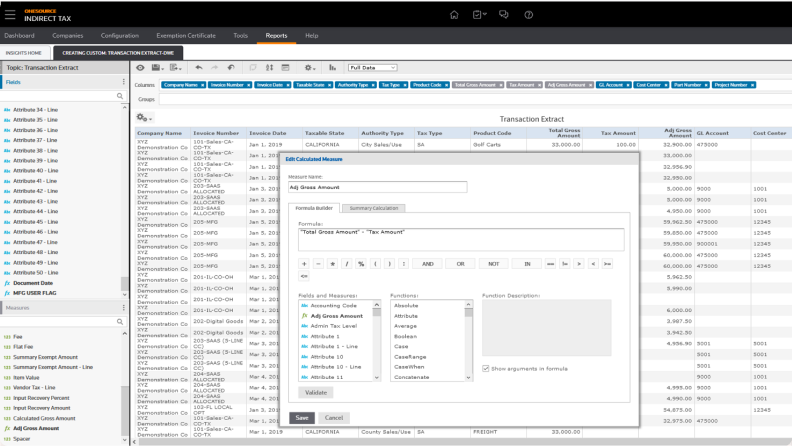

Adapt to business tax policy requirements and ensure compliance by creating custom tax rules and policies no matter where you are located.

Improved performance

Maximise control and reliability with our edge-computing deployment capabilities and save time managing it all from a single source.

See how ONESOURCE Determination works

Why choose us?

Discover the value of ONESOURCE Determination. Watch the video and learn how you could simplify your VAT determination process by configuring a company structure, setting up tax calculations for global jurisdictions, streamlining tax returns, and more.

Frequently asked questions

This solution is a VAT determination software that automates the process of calculating the appropriate tax for accounts receivable and accounts payable transactions in real time. It uses advanced algorithms and country-specific, product-specific, and customer-specific rules to accurately calculate and apply the correct tax rate to transactions instantaneously.

Our solution works by analysing transaction details such as product or service information and customer location. It then references VAT, GST, or sales and use tax rate databases and regulations to automatically calculate the correct tax amount. The goal is to ensure accurate calculation and compliance.

Accurate tax rate calculations are crucial for businesses to ensure compliance with regulations and the accurate amount of tax is being paid or refunded. Errors in tax calculations can lead to incorrect amounts of tax being paid, financial penalties, and reputational damage. Accurate transactional data is increasingly more important, especially with e-invoicing requirements and the reliance on accurate data at source. Tax engines help businesses navigate the complexities of varying tax rates and ensure the accuracy of transactions in real time.

Yes, our solution can automate the indirect tax calculation process. We designed it to handle complex global tax rules and rates, making it capable of accurately calculating indirect tax across 205 countries and territories. It can automatically apply the correct tax rates, account for exemptions or reduced rates, and calculate tax adjustments — thereby reducing manual errors and saving time for businesses in their tax calculation processes.

Our VAT calculation software can automate the calculation of accurate tax amounts on invoices. The solution integrates directly with enterprise resource planning or billing systems and ensures the correct tax rates are applied based on product or service type and the applicable tax jurisdiction. With so many global tax changes to keep current with, it is increasingly important to use a tax engine to ensure the correct rates and rules are applied to the transactions.

Absolutely. The solution is scalable, allowing small businesses to automate tax calculation processes and minimise the risk of errors.

While general tax software may cover a broad range of tax-related functions, tax engines are specifically tailored to handle the complexities of indirect tax for the supply of goods and services around the world. These tools focus on aspects such as product tax coding, real-time rate lookup, and international indirect tax compliance. The global tax content is managed and maintained within the tax engine, ensuring applicable legislative changes are applied to transactions accordingly.