Workflow ManagerPowerful workflow management software to drive your tax process

WORKFLOW MANAGEMENT SOFTWARE

Improve your compliance process with ONESOURCE

In an ever changing tax landscape, tax departments are increasingly in the spotlight to ensure they have a timely and accurate compliance process. The challenges faced include keeping up to speed on regulatory changes, increased scrutiny from governments and a lack of visibility over the compliance process. You may also need to collaborate with several departments, across various countries or regions and manage people globally which adds to the complexity.

- How do you currently monitor what deadlines need to be met globally?

- How do know who is responsible for each milestone in the process?

- How can you establish standard global tax processes?

- How can you gather and collate key information across all your entities?

How can our Tax Workflow Management Solutions help?

ONESOURCE Workflow Manager is a workflow management tool that combines automated statutory deadline tracking, document management, and data management – allowing you to take control of your compliance processes and gain visibility to the information you need with ease. ONESOURCE WorkFlow manager can be applied to any process within your organisation. The tool connects your users globally via a web-based platform, with a security model which can be administered by you. There is an audit trail providing easy access to your tax compliance history.

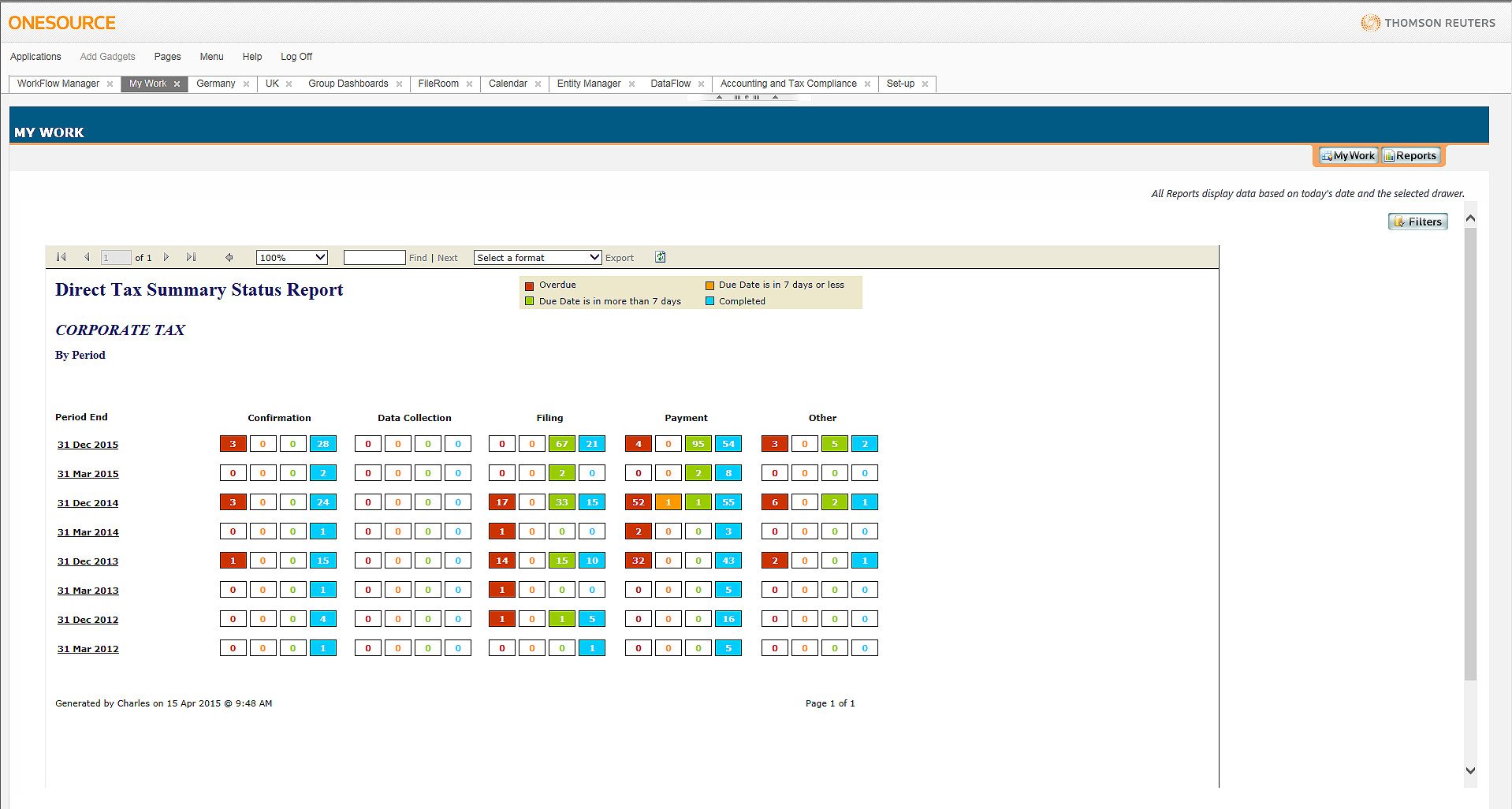

Real-Time Reporting

Customised dashboard reports allow you to easily get increased visibility and control over your key tax deadlines and potential issues in all the countries you operate in – flagging the items that need your immediate attention. Understanding and tracking your compliance obligations and those responsible in real-time will ultimately reduce your compliance risk, increase control and save time.

Related Products & Services

Resources

Brochures

Case Studies

On Demand Webcasts

Dashboard reporting allowing you to review your global status.

Automated e-mail reminders.

Due Date Tracking

ONESOURCE WorkFlow Manager provides intelligent task automation through a powerful workflow engine and comes with pre-populated and maintained statutory deadlines for Corporate Income Tax and Indirect Tax in more than 80 jurisdictions across the globe. Easily determine what deadlines you need to meet and when with an easy to use ‘to do’ list, automate notifications and alerts, prioritise and escalate tasks and track the progress of each milestone. You can instantly determine potential delinquent items and update the status of outstanding items. ONESOURCE WorkFlow Manager allows you to automate all this manual effort – accurately and efficiently.

Active workflow management of corporate income tax, indirect tax and other process deadlines which are centrally maintained and managed.

Document Management Workflow

Keep all your relevant documentation in one place with search features that help you access the information you need easily and identify where there are gaps in information. The tool ensures you have a standardised index for key information, supports documents in any format and has flexible security permissions allowing you to keep your information secure. With document management and storage in a central location, you can easily establish your tax department as a paperless office.

Online ‘FileRoom’ providing document storage and collaboration workplace for easy access worldwide.

Data Management

With ONESOURCE DataFlow, effortlessly collect, direct and manage data in any format and make it consistent. Our web-based solution integrates with existing tax packages and workpapers. Data can be collected, distributed and monitored easily, housed in a central repository for review and transferred directly to any tax software. Learn more about our tax data management software.

ONESOURCE DataFlow has been applied in many ways including:

- Providing a summary of material tax opportunities and risks

- Facilitating the application of the Controlled Foreign Companies rules

- Analysing detailed indirect tax information to help in decision making

Integration with ONESOURCE Solutions

ONESOURCE Workflow Manager is a scalable workflow platform that allows you to seamlessly integrate with ONESOURCE Corporate Tax and ONESOURCE Indirect Tax Compliance. By triggering actions in any of our compliance solutions, tasks will be closed automatically in ONESOURCE Workflow Manager.

This gives you real-time, accurate reporting on your users workload, whilst eliminating the need for manual steps to close a task in a workflow tool, reducing the burden on your users and ensuring that the status are accurate at anytime.

You may also be interested in

Indirect Tax

The only global solution to automate the complete indirect tax management process.

Learn moreDataFlow

How you manage your data and how it works for you is a big factor in continued growth.

Learn more