Making Tax DigitalStay compliant with our future-proofed MTD software solution for tax and accounting professionals

An end-to-end solution for accountants to easily navigate Making Tax Digital

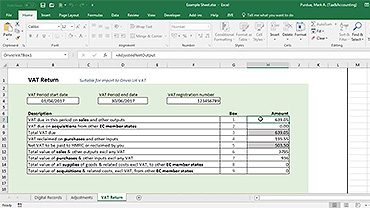

Making Tax Digital (MTD) for VAT is a UK government initiative aimed at modernising the tax system. It requires VAT-registered businesses to keep digital records and submit their VAT returns using compatible software.

Why use MTD software for VAT?

Import record keeping data

For clients who do not want to progress beyond their spreadsheet, a simple mapping and import routine collates their VAT data ready for your review and submission. This also allows for import from other bookkeeping products.

Client Collaboration

Keep in close contact with your clients using our portals that allow for seamless notifications and exchange of data to enhance the experience and improve efficiency, whilst also allowing for client approval of the VAT data before reporting to HMRC.

VAT reporting

Regardless of the source of the digital records, a simple to use tool for collation and reporting the MTD for VAT data to HMRC.

Process Management

Define streamlined processes to match the services that you provide to your clients — vital for efficient working.

Related resources

MTD for VAT Solution Demonstration

Onvio VAT solution has been developed to simplify the compliance process and automate your VAT.

Watch video [5 mins]