Tax Professionals 2022 Report: Efficiency

29 April 2022 - 5 min read

SECTION 1: STRATEGIC PRIORITIES

At the start of 2021, tax professionals were emerging from the pandemic survival mode and hoping the new year would allow them to return to some semblance of normality. After all, most accounting firms had adapted quite well to remote work, and expectations were that the economy would start to recover in 2021.

Interestingly, as 2021 progressed and tax professionals grew more accustomed to working hybrid schedules, their priorities shifted. Prior to the pandemic, tax leaders were focused primarily on growing their businesses. In September, however, while respondents were still focused on growth, it had been overtaken in priority by a concern about recruiting and training of new and existing talent.Personnel development was especially important in firms with four or more people, but that desire also extended to individuals eager to improve their own skills.

Going into the last three months of 2021, the strategic priorities for tax advisors were centred around these general themes:

- Talent — attracting and recruiting new people; developing and retaining existing talent

- Growth — increasing revenue and attracting new clients

- Efficiency — streamlining processes and leveraging technology to increase productivity

- Client Service — offering more strategic business advice, better response times, and more effective communication

In this year’s survey, differences of emphasis will of course depend upon the size of a firm and the actual roles respondents play in their organisations. Continued growth did bounce back as a strategic priority after dipping somewhat during the pandemic, and squeezing more efficiency out of processes and technologies is never far from management’s mind. Further, uncertainties exposed by the pandemic appear to have prompted a re-dedication to both excellence in client services and tax planning.

Priority 3: Efficiency

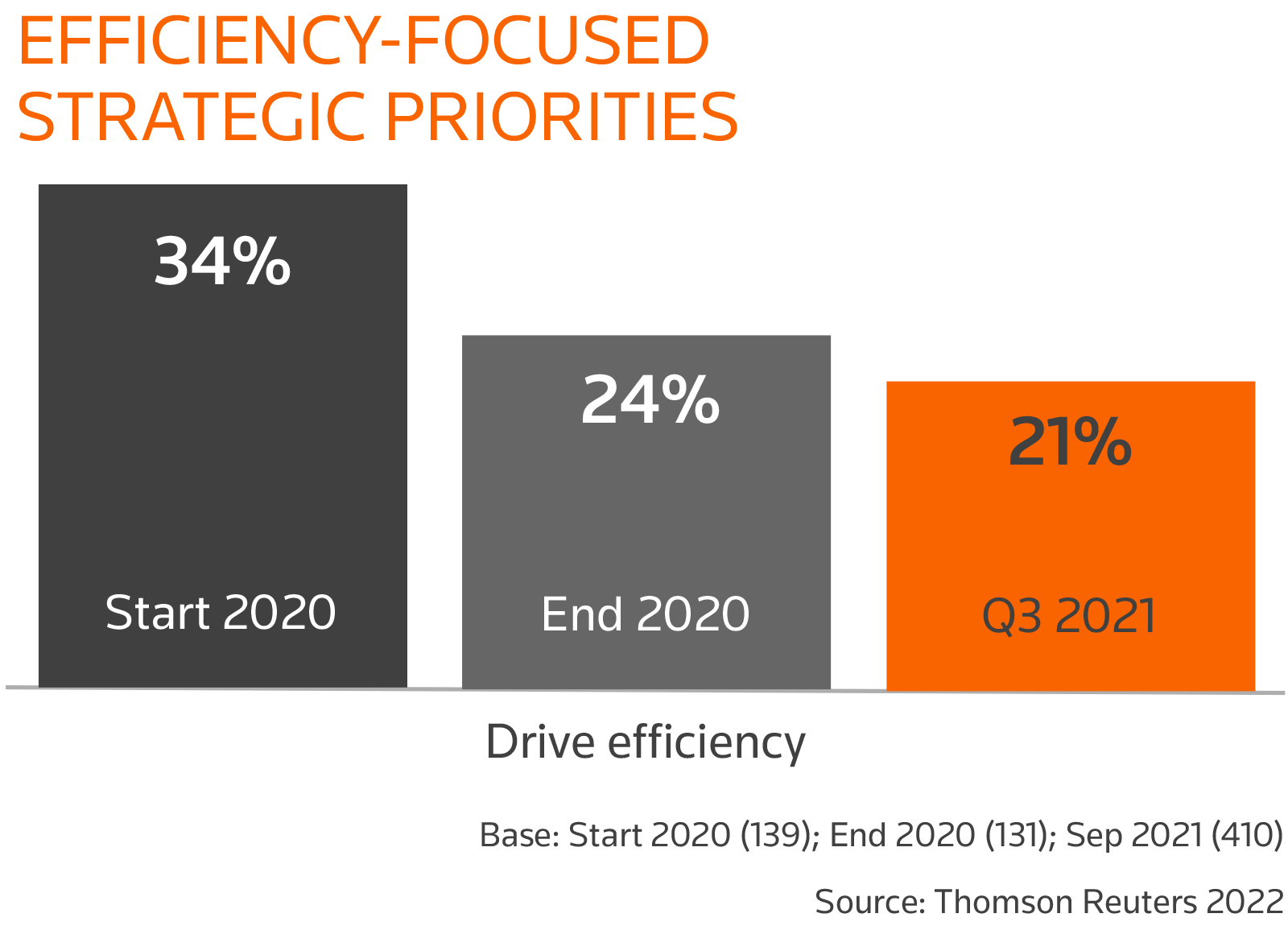

At the start of 2020, before the pandemic hit, the top strategic priority for tax leaders, particularly at firms employing more than 30 people was driving operational efficiency. By September of 2021, however, other priorities — namely talent and growth — had pushed efficiency down to the number three slot.

Prior to the pandemic, in fact, more than one-third (34%) of accounting firms rated improving efficiency as their top priority. That number dipped to 24% during the pandemic, then dipped even further by September 2021, when only 21% of firms rated efficiency as their top concern — yet another indication of how the pandemic has affected tax priorities.

Nonetheless, improving efficiency remains a top priority for most firms. Progress in this area requires an individual or group of individuals to take responsibility for driving the agenda — unfortunately, our research shows this may be lacking at many firms. While leaders at all levels identify improving internal efficiency as one of their firm’s strategic priorities, few individuals at the owner, manager/director, or non-leadership levels see the efficiency drive as a motivator for them personally. As a result, firms that lack people keen to own the efficiency agenda risk making limited progress toward their goals. And at firms where this gap exists, recruiters may be wise to look not only for technology skills but also for those individuals who demonstrate a real drive to improve operational efficiency.

Technology or training?

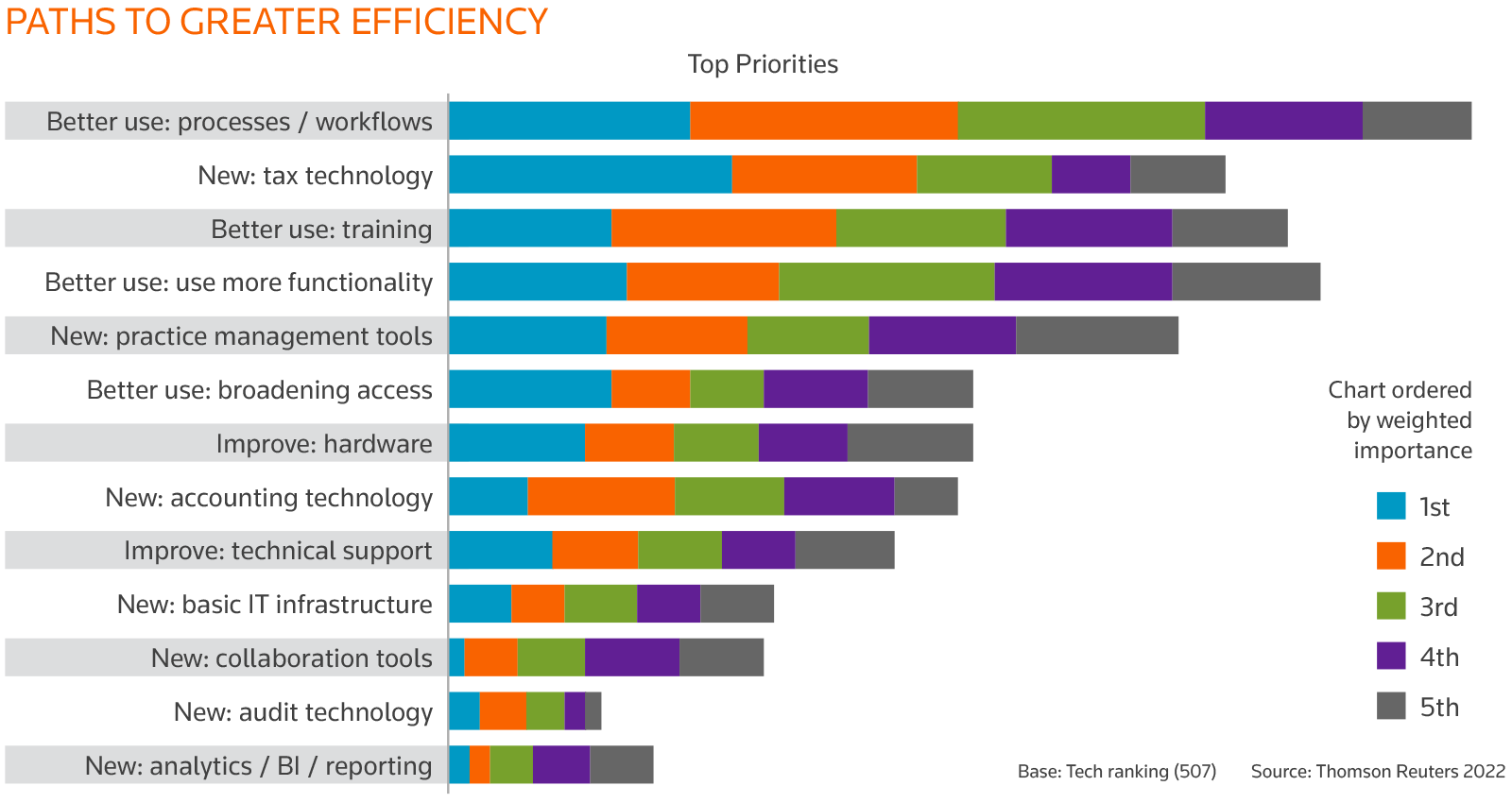

Efficiency can be improved in a number of different ways, including making investments in the latest technology or simply training employees to make better use of the technology they already have.

In firms with more than 30 employees, investing in new tax technologies is the preferred route to greater efficiency. For leaders in larger firms, new analytics tools and auditing technologies are also at the top of their technological wish list, followed by new practice-management tools, accounting software, and general improvements in the firm’s basic IT infrastructure and technical support.

Overall, however, firms with fewer than 30 employees are seeking to find efficiencies by training people to make more knowledgeable use of the technologies the firm already uses, and by improving their teams’ processes and workflows.

CONCLUSION

As economies around the world slowly recover from the pandemic’s persistent shock waves, tax professionals are well-positioned to provide the range of services and guidance their

clients will need in 2022 and beyond. Wisely, tax leaders are taking this opportunity to reassess their priorities and remind themselves that investing in top-quality talent and supporting the professional growth of their employees is essential to the health and well-being of both the business and its workers.

The pandemic appears to have prompted a long-overdue re-evaluation of what it means to be an effective tax advisor and how important a loyal, well-trained team of tax professionals

is to a firm’s overall resilience and viability. It may be a bit too early to call this a revolution, but a renewed emphasis on recruiting and developing a firm’s human capital suggests that

at least some tax leaders recognise the inescapable connection between people and profit, and are taking steps to show valued employees that they are not — and should not be —

taken for granted.

Though most of the work at small to midsize accounting firms still involves processing tax returns for individuals and businesses, the trend toward offering a broader range of business

advisory services is taking hold at all levels, primarily because clients are begging for it. A whopping 95% of this survey’s respondents said their clients are asking for more tax planning, business, and financial advice, and that means that the door of opportunity is wide open for those firms that are willing to walk through it.

Get your Tax Professionals 2022 Full Report

Don't miss this full report that provides insights and guidance on all 4 top priorities for tax professionals and link to https://tax.thomsonreuters.co.uk/downloads/reports/tax-professionals-2022-report

Download Special Report PDF - 871KB