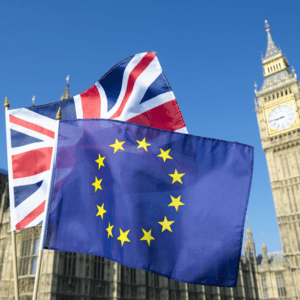

Brexit implications on Financial Reporting

Although there are no financial reporting requirements that relate specifically to Brexit, companies are required to disclose information such as key assumptions about the future, and other key sources of estimation uncertainty and the possible impairment of assets. The impact of Brexit will therefore vary from industry to industry and business to business: those with […] … Read More