Corporate Tax – NetherlandsTransforming Corporate Income Tax Compliance

Fast, accurate company tax returns with ONESOURCE

Demands around corporate income tax compliance are increasingly complex in today’s changing environment. Common concerns relate to data integrity, data transparency, risk management and the requirement to respond rapidly to changing regulations, all of which are reflected in the new Netherlands tax audit policy (Controle Aanpak Belastingdienst). It is increasingly necessary to ensure adequate controls are in place to manage risk, demonstrate “reasonable care” and avoid penalties.

Many organisations are finding their tax professionals are consumed by the manual aspects of the compliance process such as data collection and the presentation of disclosures, rather than adding value to the business. In addition, maintaining up to date content and tracking key changes in the tax regime is increasingly arduous.

How our corporate tax return software helps Netherlands corporations

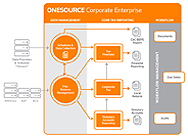

Designed specifically for companies in the Netherlands, ONESOURCE Corporate Tax is a comprehensive solution to manage the complete tax compliance process. ONESOURCE Corporate tax handles all the SBR/XBRL e-filing requirements of the Belastingdienst (Dutch Tax Authority) and Thomson Reuters tax professionals monitor all changes to the Netherlands tax regulations to ensure the solution is always up to date with the latest tax rules.

Extensive features, including an audit trail and versioning, make it easy to review your returns and prior year’s information is automatically rolled forward saving time and improving accuracy. With a transparent architecture, clickable cross references, cross-checking and reconciliations, the reviewer of the tax return is assured that computations have been prepared correctly and that the risk of penalisation has been mitigated.

Simplify corporate income tax with ONESOURCE

Key features of ONESOURCE Corporate Tax Netherlands include:

- XBRL e-filing supported

- Transparent logic allows you to see how the tax due has been calculated and to trace numbers back from return to the source

- Full automatic cross referencing

- Full intelligent carry forward of numbers

- Provides full audit trail

- Supports automated data collection

- Fiscal Unity consolidation including sub-consolidations

- Supports custom code reporting

- Support for domestic and foreign taxpayer tax returns

- Commercial fiscal differences reconciliation

- Supports company-only tax due calculations

- Extensions and assessments support

- Provisional assessments and administration module

Related Products and Services

Brochures

You may also be interested in

Indirect Tax

The only global solution to automate the complete indirect tax management process.

Find out moreWorkFlow Manager

Powerful workflow management software that drives your tax process.

Find out moreTax Provision

Take the stress out of managing the process with our tax provision software.

Find out more