ONESOURCE DataFlow for Tax ReportingCorporate tax reporting software

Why choose ONESOURCE DataFlow for Tax Reporting?

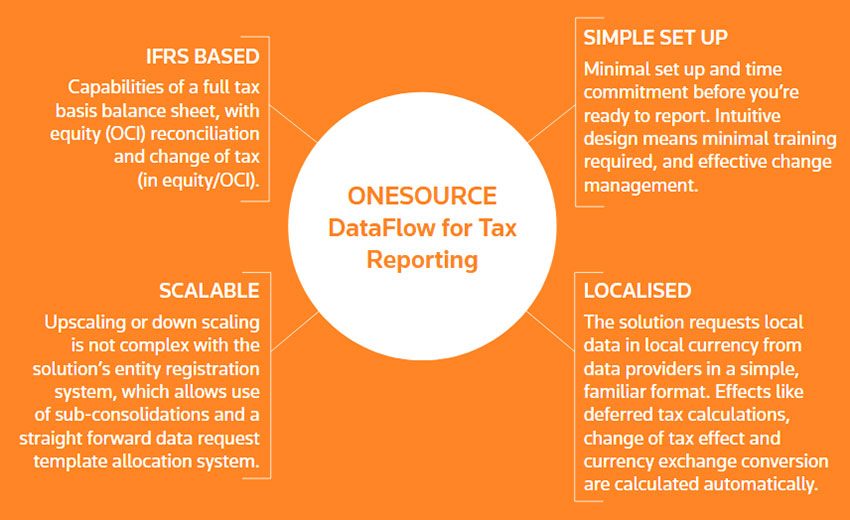

When it comes to financial close, you need an IFRS-based reporting solution that provides you with the efficiency and precision you need to support your tax disclosures with confidence. Thomson Reuters ONESOURCE DataFlow for Tax Reporting is our new and simple solution to IFRS-based tax reporting.

With our corporate tax reporting software, you’ll be able to streamline laborious tasks like data entry, saving you valuable time for data analysis and reducing the chance for human error — in one automated, centralised solution.

Video

What you get with our corporate tax reporting software

Automated reporting

Data providers are guided to a structured way of reporting through automated calculations and validations.

User guidance

With version control, audit trail, and user access controls, users are guided from start to finish and the chance of human error is minimised.

Time savings

Consolidate data in seconds, so you have ample time for data analytics and other value-added activities.

One central database

Your tax reporting data, combined with supporting documentation, can be monitored — in one centralised system.

How it works – See ONESOURCE DataFlow for Tax Reporting in action

An intuitive corporate tax reporting solution to speed up your financial close.

Integrate both structured ERP data and unstructured data into an extensive, IFRS-based, tax reporting framework which is both simple to set up, and simple to use.