Corporate Tax – UKCorporation tax software for the United Kingdom

ONESOURCE for UK Corporation Tax

The preferred software for corporation tax returns

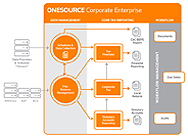

The increased focus on UK corporate tax affairs and the need for tax departments to become more efficient at the same time as becoming more transparent requires organisations to re-think their tax processes. Specialist corporate tax technology solutions such as ONESOURCE Corporate Tax UK can help organisations increase accuracy and decrease risk across the streamlined compliance process.

Simplify UK corporation tax returns including CT600, P11D and SA800

ONESOURCE Corporate Tax UK is a comprehensive tax management solution that improves the efficiency of tax departments in calculating and submitting the CT600 and other tax returns to HMRC and giving the users confidence in the final tax computation. ONESOURCE Corporate Tax provides easy to use features that guide users through the complete process including:

- Automated source data collection from trail balance, spreadsheets or accounting systems

- Complete audit trail, automatic error and consistency checking and transparent cross referencing between all schedules

- Fully iXBRL compliant tax return and computation can be submitted in one easy step with our e-filing Wizard

- Explanatory notes can be added to the data to help the reviewer and inform authorities in order to reduce review time

- Group function provides an up-to-date view of the tax position for groups, and controls group relief and group payment allocations

- Built in legislative references and up to date tax content supported by tax professionals

- Automatic rolling forward of information from prior year

The UK corporation tax software of choice

Used by over 50 of the FTSE100 companies as well as many of the large accounting firms, ONESOURCE Corporate Tax UK is developed and supported by UK tax professionals for UK tax professionals. Our local team constantly monitors HMRC and HM Treasury legislation to ensure that ONESOURCE Corporate Tax UK is always compliant with current regulations, removing the stress and work from keeping up with the constantly changing tax environment.

See also our Corporation Tax solution for Accounting Firms

Thomson Reuters also offers Corporation Tax Advanced for accounting firms, part of The Digita Professional Suite.

Learn more about Corporation Tax AdvancedStandard features of ONESOURCE Corporate Tax UK include:

- Tax accounting schedules for FRS101/102

- Patent Box schedules

- Research and development expenditure credit (RDEC) schedules

- Controlled foreign company (CFC) schedules

- Foreign branches

- Fixed assets and capital allowances

As well as managing the HMRC CT600 return, ONESOURCE Corporate Tax UK can also help manage specialist tax areas including:

On Demand Webcasts

Partnerships

ONESOURCE tax compliance for partnership deals with trading, investment and property partnerships consisting of individual, non-resident, corporate and mixed partnerships. It includes full business tax schedules to produce computations on income tax and/or corporation tax principles, allocation schedules, tax reserve calculation summaries and appropriate reconciliations. Changes of accounting date are also catered for, as are adjustments for joiners and leavers.

Life Assurance

Designed for both mutual and proprietary organisations, as well as producing the CT600 and e-filing returns, ONESOURCE Corporate Tax calculates instalment payments, and may be easily adapted for tax provisions for accounting purposes under both UK GAAP and IFRS. Any number of commercial blocks of business can be created, and all categories of business – BLAGAB, non-BLAGAB, LTBFC-and-other, Exempt, and, for composites, General – are supported, utilising a range of different apportionment methods.

Authorised Investment Trusts

Produces the tax computation (with supporting schedules at the option of the user), the Inland Revenue CT600 return form and supports the tax accounting calculations required for unit pricing purposes for both Unit Trust and Open Ended Investment Company (OEIC) types of computation.

Investment Funds Trusts

ONESOURCE Corporate Tax for Investment Trusts is used to calculate distributable income for the interim distribution period and the full accounts period, whilst simultaneously providing full tax accounts for both periods.

Petroleum Revenue Tax

Designed for both participators and operators, ONESOURCE Corporate Tax UK provides comprehensive assistance in preparing the PRT returns and related expenditure claims, including the PRT 30, 40, and 60, Participator’s additional return, Tariffs, nominations and appropriations as well as free standing expenditure claims.

Ready for UK Corporation Tax Reporting Under New FRS 102 Standard

From 1 January 2015 the framework for UK GAAP will change, with companies having to adopt a new standard for accounting periods commencing on or after that date. “New UK GAAP” will represent a major change for most organisations and many organisations are yet to take the decision as to which standard they will choose.

What is clear is that for those companies opting for FRS102, the tax department will be faced with the challenge of how to report tax under this new accounting standard. In support of our customers, Thomson Reuters ONESOURCE has launched new FRS102 tax accounting sheets, harnessing the proven technology of our market-leading tax compliance software, ONESOURCE Corporate Tax.

You may also be interested in

Indirect Tax

The only global solution to automate the complete indirect tax management process.

Find out moreWorkFlow Manager

Powerful workflow management software that drives your tax process.

Find out moreTax Provision

Take the stress out of managing the process with our tax provision software.

Find out more